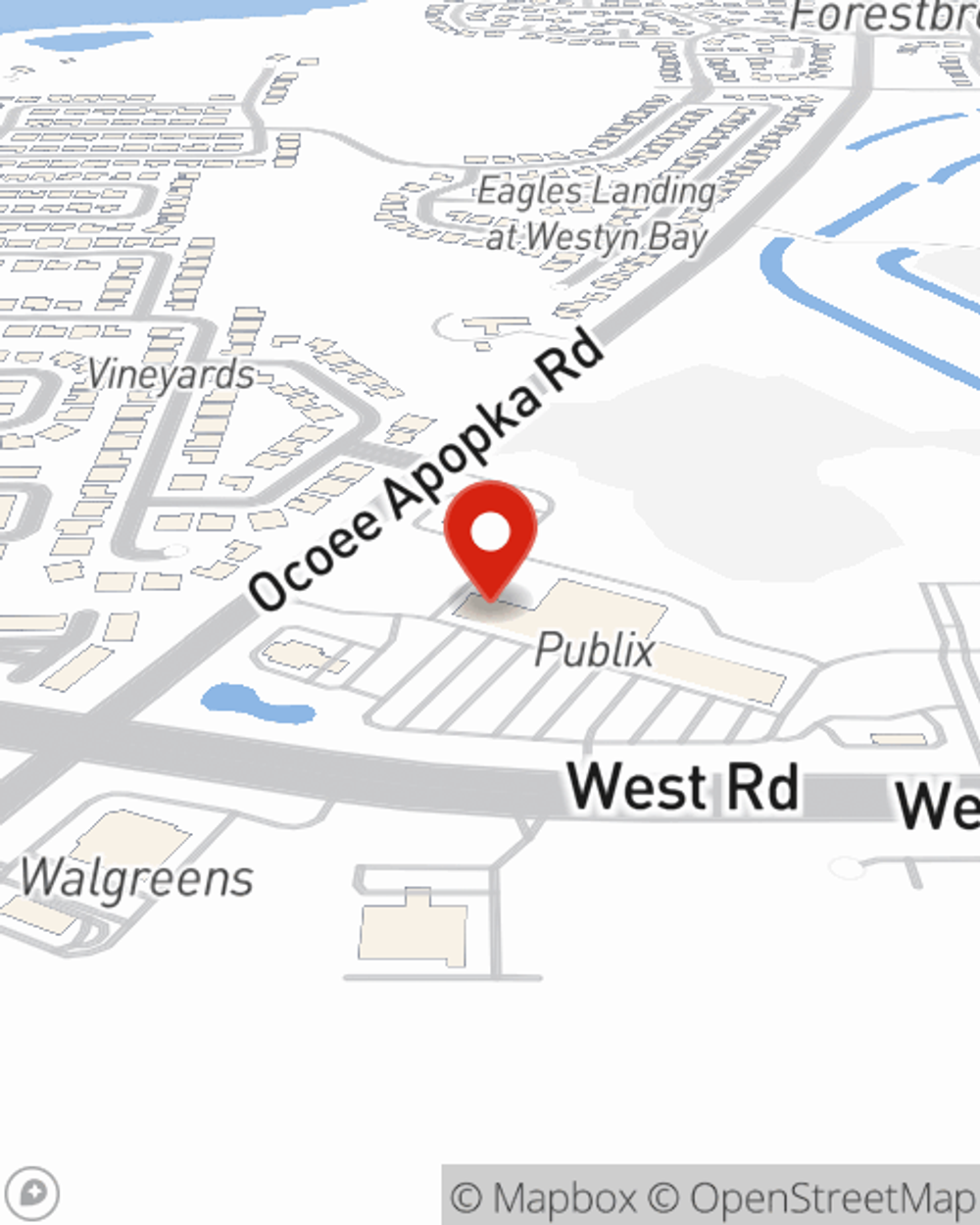

Homeowners Insurance in and around Ocoee

Looking for homeowners insurance in Ocoee?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Florida

Welcome Home, With State Farm Insurance

With your home covered by State Farm, you never have to worry. We can help you make sure that in the event of damage from the unpredictable tornado or fire, you have the coverage you need.

Looking for homeowners insurance in Ocoee?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Open The Door To The Right Homeowners Insurance For You

If you're worried about navigating life's troubles or just want to be prepared, State Farm's dependable coverage is right for you. Generating a policy that works for you is not the only aspect that agent Jo Barsh can help you with. Jo Barsh is also equipped to assist you in filing a claim if something does happen.

As your good neighbor, State Farm agent Jo Barsh is happy to help you with getting started on a homeowners insurance policy. Get in touch today!

Have More Questions About Homeowners Insurance?

Call Jo at (407) 299-0301 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.